When investing in off-plan real estate in Dubai, one of the most crucial steps is understanding the RERA forms for off-plan properties. The Real Estate Regulatory Agency (RERA) – part of the Dubai Land Department (DLD) – has established standardised forms to safeguard all parties in property transactions, ensure transparency, and regulate dealings between buyers, sellers, developers, and brokers. These forms introduce clarity to the contractual process, protect investor rights, and help prevent disputes throughout the off‑plan purchase journey.

What Are RERA Forms and Why Do They Matter?

RERA forms are official documents crafted to formalise every phase of a property transaction. In the context of off‑plan properties – where the property is purchased before completion – these forms help protect buyers by setting clear terms, documenting broker engagements, defining payment structures, and ensuring compliance with Dubai’s real estate laws. Using RERA‑approved forms also minimises conflict by clearly outlining the responsibilities and expectations of each party involved.

Key RERA Forms for Off-Plan Properties Transaction

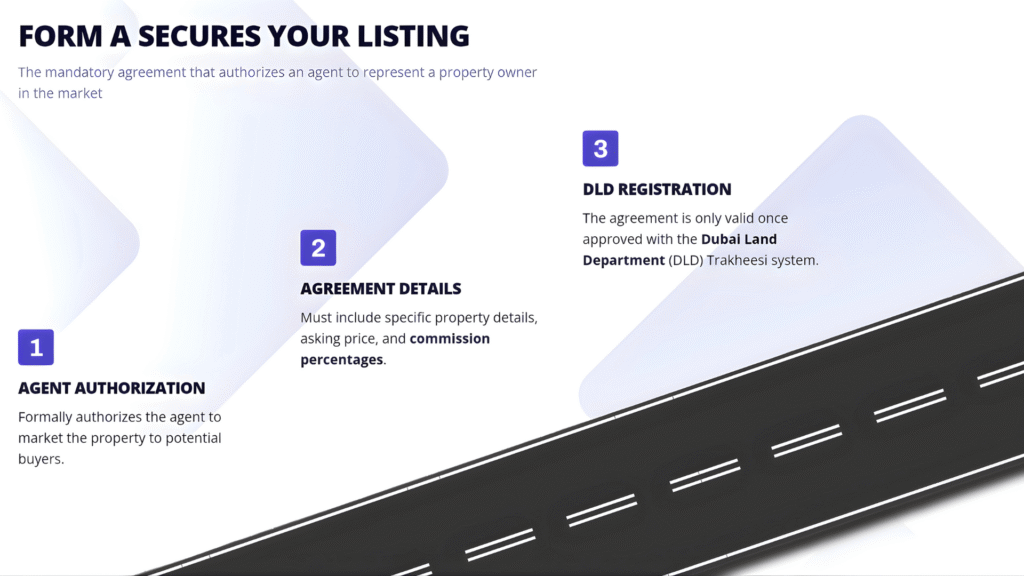

1. RERA Form A – Seller and Broker Agreement

RERA Form A is the first contract in many real estate transactions. It’s an agreement between the seller (or developer) and the licensed real estate broker authorising the broker to market the property. The form outlines the property details, like asking price, duration of the broker’s appointment, commission percentage, broker’s duty, marketing rights & terms. Before any property is marketed, this form must be signed and submitted to RERA, which will then authorise the listing of the property on official platforms like the DLD’s Ejari system.

2. RERA Form B – Buyer and Broker Agreement

Form B is an agreement between the buyer and their chosen broker. It lists the buyer’s preferences (such as location or type of property), the commission terms (if applicable), and the duration of the broker’s mandate. With this form, buyers confirm which agent will represent them in identifying suitable off‑plan opportunities and negotiating terms. It clearly defines the broker’s duties, commission structure and amount, as well as the contract duration, helping to avoid misunderstandings and conflicts of interest.

3. RERA Form F – Memorandum of Understanding (MOU)

Perhaps the most crucial document in off‑plan transactions is the RERA Form F – also known as the Memorandum of Understanding (MOU). Form F contains details of the agreed sale price, payment terms, handover dates, and broker commission. Form F is signed once the buyer and seller agree on key terms. It must be witnessed and signed by the broker to become legally enforceable.

4. Sale and Purchase Agreement (SPA)

Though not a RERA “form” in the classic sense, the Sale and Purchase Agreement (SPA) is an essential part of off‑plan documentation. This legally binding contract between the developer and the buyer. It records all the specifics of the off‑plan sale, such as construction milestones, payment milestones, completion dates, and developer obligations. For off‑plan properties, the SPA is aligned with RERA and DLD guidelines and is often required to be registered with the DLD’s Oqood system after initial signing.

5. No Objection Certificate (NOC)

The NOC plays an important role in the documentation process. Developers issue an NOC to confirm that the buyer has fulfilled all payment obligations and that there are no outstanding dues before transferring ownership.

6. RERA Form U – Termination Agreement

If a buyer or seller wants to terminate an existing engagement with a broker (for example, cancelling Form A or Form B), RERA Form U is used. This form requires written notice to the broker, including the reason for termination and the effective date, ensuring that the cancellation is legally binding.

How RERA Forms Support Off‑Plan Property?

Transparency

RERA forms are integrated with Dubai’s official registration platforms, such as Oqood, which records off‑plan sales and protects the buyer’s interest by creating an official ownership trail even before construction completion. This system, alongside RERA forms, ensures accountability, helps enforce contract terms, and gives buyers confidence that their investments are legally protected within Dubai’s fast‑growing real estate market.

Conclusion of RERA Forms for Off-Plan properties:

Understanding the RERA forms for off‑plan properties in Dubai is essential for anyone considering an off‑plan investment. From initiating a broker agreement (Form A or B) to formalising the sale through Form F and managing contract changes with Form U, these standardised documents provide a clear legal structure that protects your rights and promotes smooth property transactions. Being familiar with these forms not only simplifies the buying process but also ensures that you are compliant with Dubai’s regulatory framework every step of the way.